California is a remarkable place to live, not simply as it keeps a great deal of views to see, coastlines to see, and Disneyland to see, and while the condition has the benefit of several strong Federal Student loan Forgiveness Software to citizens tucked within the university mortgage obligations.

Whoever stays in the fresh Golden County and you may who is stressed along with their funds is to listen up, just like the California’s education loan forgiveness software rank between the best in the complete country, offering outstanding advantageous assets to individuals who be eligible for the new prize.

For education loan forgiveness into the Ca, you’ll want to feedback the new offered forgiveness programs lower than, expenses attention on their Qualifications Regulations, and you can Software Procedures to determine which system will work perfect for your.

Get Help with Your Finance!

If you are it is experiencing education loan obligations, then you certainly should consider spending a student loan Credit card debt relief Company to have let. As to why? Because the individuals operating during the these businesses handle student education loans for hours on end, every day, plus they are your best options at the determining ways to get their finance right back down.

To have assistance with Government Figuratively speaking phone call the Education loan Relief Helpline during the step 1-888-906-3065. Might remark your own instance, evaluate the options having altering cost preparations, merging the loans, otherwise looking for forgiveness professionals, next set you up to finish your debt as the easily that one can.

For advice about Private Student education loans call McCarthy Law PLC at 1-877-317-0455. McCarthy Laws have a tendency to negotiate with your bank to repay your private financing for much less than simply your currently are obligated to pay (normally 40%), up coming provide a different financing on straight down, paid amount so you can pay off the existing loan, resolve your borrowing from the bank and reduce your monthly installments.

You will find spent a decade choosing credit card debt relief firms, conversing with a myriad of «experts», and these are the just a few companies that We faith to help you assist my personal subscribers. For those who have a detrimental experience with possibly of those, delight be sure to go back and you may let me know in the they about Statements!

The Steven Meters. Thompson Physician Corps Mortgage Payment

The new Steven Yards. Thompson Doctor Corps Loan Fee program repays to $105,000 into the qualified figuratively speaking in return being employed as a doctor for the a ca HPSA.

- You should be an enthusiastic allopathic otherwise osteopathic physician

- You really must be without one contradictory contractual solution loans

- You’ll want outstanding informative loans from a government or industrial financial institution

- You must have a legitimate, unrestricted permit to rehearse drug inside Ca

- You must be already employed otherwise have approved a position for the an excellent Health professional Lack Section (HPSA) into the California

- You should agree to getting full-time head patient worry within the a great HPSA to possess no less than three-years

The fresh new Ca Condition Mortgage Repayment System

The fresh California Condition Loan Payment Program offers to help you $fifty,100000 altogether education loan forgiveness benefits. This choice authorizes costs from educational fund so you’re able to medical researchers exactly who invest in routine inside the areas of the official that have been considered getting clinically underserved.

- You must haave a recently available unrestricted California permit.

- You must be an effective United states citizen

This new CDA Basis Education loan Repayment Give

The fresh new CDA Foundation Student loan Installment Offer honours gives to pick present loans Eldorado Springs CO dental college/expertise graduates. Such grants support career solutions by the permitting present students pay the finance, and will be offering around $thirty-five,one hundred thousand within the forgiveness advantages a year, with a total of $150,100000 more three years. Including the other programs listed above, the fresh individual has to invest in bringing proper care into the a clinically undeserved area. Concurrently, if you are an offer athlete-upwards, the latest Webb Friends Offer often prize as much as $5,100000 toward upcoming degree expenses.

Will i Owe Taxes back at my Forgiven Obligations?

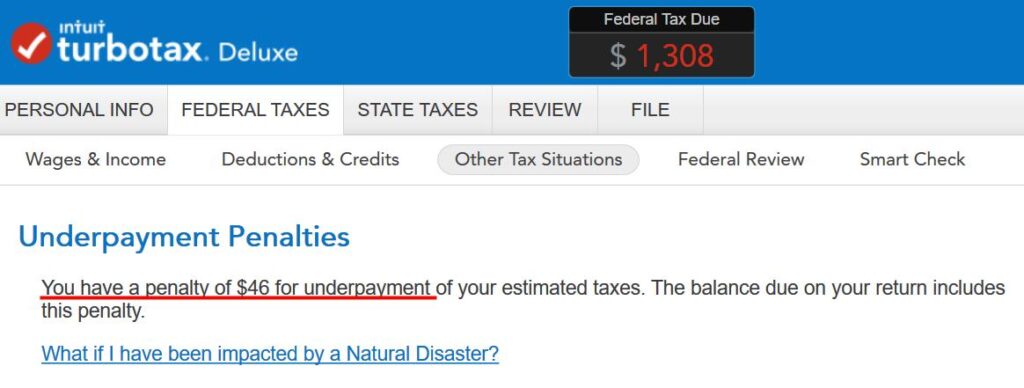

There clearly was a definite options that you’re going to are obligated to pay fees towards the new forgiven loans, except if their education loan contains that loan forgiveness supply centered on service on the arena of work.

According to the current Internal revenue service regulations, what the law states states you to definitely one obligations forgiveness obtained need to number because the taxable income, if you got $10,000 in the figuratively speaking forgiven, you’d must record you to definitely $10,100 because money on the income tax go back, and you may pay taxes up against it. To possess details on just how that it performs, please go to my personal web page towards Education loan Forgiveness and Nonexempt Earnings Statutes.

This will cause enormous problems for individuals have been made use of to creating brief, monthly payments against their student loans, however, which can find themselves facing a huge, lump-contribution money due to the Internal revenue service.

In my opinion it’s like problematic one to We have dependent an entirely the website to let people with tax-related issues, titled Skip Income tax Debt. To your Forget Tax Debt, We provide taxation and fees-related suggestions, just like I actually do right here to have figuratively speaking.

Where Must i Choose Most other Issues?

To have questions regarding general education loan rescue, whether you desire assistance with Government or Personal finance, make sure to visit the most other users regarding my personal web site, which cover the niche for the exhausting detail.

When you have another questions relating to California education loan forgiveness benefits, forgiveness, otherwise cancellation software, please get off her or him in the comments area lower than and I’ll would my best to respond to him or her in 24 hours or less.

Disclaimer:Advice extracted from Forget about Student loan Debt is for academic motives merely. You ought to consult an authorized monetary top-notch prior to any financial behavior. The website obtains some payment because of associate relationship. The site is not supported otherwise affiliated with the newest U.S. Service off Studies.

By: Tim Marshall

Tim’s sense suffering from smashing student loan financial obligation contributed your to produce the website Disregard Student loan Personal debt last year, where the guy offers pointers, tips and tricks to have repaying figuratively speaking as easily and you can affordably you could.