Consulting with a qualified accountant or financial expert is advisable to ensure compliance with applicable accounting standards and regulations. Assume the investors pay $9,800,000 for the bonds having a face or maturity value of $10,000,000. The difference of $200,000 will be recorded by the issuing corporation as a debit to Discount on Bonds Payable, a debit to Cash for $9,800,000, and a credit to Bonds Payable for $10,000,000. The difference between the amount received and the face or maturity amount is recorded in the corporation’s general ledger contra liability account Discount on Bonds Payable. This amount will then be amortized to Bond Interest Expense over the life of the bonds. After the payment is recorded, the carrying value of the bonds payable on the balance sheet increases to $9,408 because the discount has decreased to $592 ($623–$31).

- A bond that is issued at a discount is a bond that has been issued for less than the par value of the bond.

- See Table 4 for interest expense and carrying value calculations over the life of the bonds using the effective interest method of amortizing the premium.

- After the payment is recorded, the carrying value of the bonds payable on the balance sheet increases to $9,408 because the discount has decreased to $592 ($623–$31).

- In effect, the discount should be thought of as an additional interest expense that should be amortized over the life of the bond.

- Bonds are debt securities that companies and governments use to raise capital, and they typically come with a fixed interest rate and a maturity date when the principal amount is repaid to the bondholders.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

Accounting for Bonds Issued at a Discount FAQs

See Table 3 for interest expense and carrying value calculations over the life of the bond using the straight‐line method of amortization . Thomson Reuters can help you better serve clients by delivering expert guidance on amortization and other discount on bonds payable cost recovery issues for more tax-efficient decisions. A bond, which is a limited-life intangible asset, is essentially a loan agreement between the issuer of the bond (i.e., corporation, government, or municipality) and the bond holder.

Suppose some investors purchase these bonds that will be worth $20,000,000 at maturity for $19,600,000. Amortized bonds differ from other types of loans and helping clients better understand bond amortization can further strengthen your role as a trusted advisor. Amortization schedules, bonds payable, bond calculation methods, and more. If the discount amount is immaterial, the parent and contra accounts can be combined into a one balance sheet line-item. The debit balance in the Discount on Bonds Payable account will gradually decrease as it is amortized to Interest Expense over their life.

Over the life of the bond, the balance in the account https://business-accounting.net/ must be reduced to $0. Reducing this account balance in a logical manner is known as amortizing or amortization. Since a bond’s discount is caused by the difference between a bond’s stated interest rate and the market interest rate, the journal entry for amortizing the discount will involve the account Interest Expense. An analyst or accountant can also create an amortization schedule for the bonds payable. This schedule will lay out the premium or discount, and show changes to it every period coupon payments are due.

Example of a Bond Discount

If the Coupon Rate on the New Bond is 6% and prevailing Market Rates are approx 4% – Potential Buyers of the Bond would be willing to pay more for this bond and it is gonna sell at a Premium. According to FASB Statement No. 4, gains and losses from voluntary early retirement of bonds are extraordinary items, if material. We report such gains and losses in the income statement, net of their tax effects, as described in Unit 15. The FASB is currently reconsidering the reporting of these gains and losses as extraordinary items. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more.

How confident are you in your long term financial plan?

But, when the company sold the bonds to some investors, there was a market interest rate of 5.2%. For an example of a bond discount, suppose that a company is preparing to issue some bonds that, at maturity, will be worth $20,000,000. Using the straight-line method, bond amortization results in bond discount amortization values that are equal throughout the term of the bond. For investors, there can be tax implications for the amortization of bond premiums or discounts. For risk-adverse investors, bonds can be an attractive way to receive an anticipated return and safeguard capital.

Since the company now OWES this money to the Investors, they have created a LIABILITY on their books. You have the company, which is now the BOND ISSUER and has borrowed the money. Individuals are willing to lend the money NOW because they will have the right to earn INTEREST on the money they have given for years into the future. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Watch this video to see how we retire bonds when the the bond was originally issued at a discount. Discount on Bonds Payable is a contra liability account with a debit balance, which is contrary to the normal credit balance of its parent Bonds Payable liability account. Short-term bonds are often issued at a bond discount, especially if they are zero-coupon bonds. However, bonds on the secondary market may trade at a bond discount, which occurs when supply exceeds demand. Bond discount is the amount by which the market price of a bond is lower than its principal amount due at maturity. The Discount on Bonds Payable serves as a way to adjust the actual cost of borrowing for the issuing company when bonds are sold at a discount, as it effectively increases the interest expense over the bond’s life.

At the end of the schedule (in the last period), the premium or discount should equal zero. At that point, the carrying value of the bond should equal the bond’s face value. A basic rule of thumb suggests that investors should look to buy premium bonds when rates are low and discount bonds when rates are high. Because premium bonds typically provide higher coupon payments, the biggest risk is that they could be called before the stated maturity date. The bonds are issued when the prevailing market interest rate for such investments is 14%. The premium account balance represents the difference (excess) between the cash received and the principal amount of the bonds.

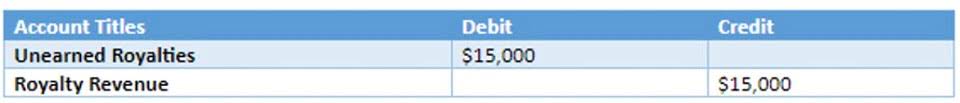

The discount on bonds payable is treated as a contra-liability account, which means it reduces the bonds payable balance on the balance sheet. Over the life of the bonds, the discount is amortized, and the carrying value of the bonds payable increases. Discount amortizations are likely to be reviewed by a company’s auditors, and so should be carefully documented. Auditors prefer that a company use the effective interest method to amortize the discount on bonds payable, given its higher level of precision. If there was a discount on bonds payable, then the periodic entry is a debit to interest expense and a credit to discount on bonds payable; this has the effect of increasing the overall interest expense recorded by the issuer.

To calculate the bond discount, the present value of the coupon payments and principal value must be determined. Thus, bonds payable appear on the liability side of the company’s balance sheet. This account is amortized over the life of the bond using methods such as the straight-line or effective interest method. If the stated interest rate on a bond is less than the market interest rate, it is not uncommon for an investor to pay less than the face value of the bond. In this instance, the difference between the face value and the amount paid is placed in a contra liability account, and the amount of the reduced payment is amortized over the term of the bond.

Reliance on any information provided on this site or courses is solely at your own risk. A company may add to the attractiveness of its bonds by giving the bondholders the option to convert the bonds to shares of the issuer’s common stock. In accounting for the conversions of convertible bonds, a company treats the carrying value of bonds surrendered as the capital contributed for shares issued. In the video example, the carrying value of the bonds are $61,750 calculated as Bonds Payable $65,000 – Discount on Bonds Payable remaining $3,250. The cash we paid to retire the bonds is $66,150 which is greater than the carrying value of the bond of $61,750 so we are paying more to retire the bond than it is worth and we record a loss for the difference of $4,400 ($66,150 – $61,750). If the cash we paid is less the carrying value of the bonds, we are paying less than the bonds are worth so we get to record a gain on the retirement of the bonds.

What Is a Discount on Bonds Payable?

The bond will have a conversion feature that allows it to be converted into shares; an investor would presumably exercise the conversion right if the market price of FCA rises to an appropriate level at some future date. If the market price does not increase suitably, then the bondholder would simply hold the bond without converting it into FCA stock. A premium bond is one for which the market price of the bond is higher than the face value.