No matter what experienced you are with budgeting and you will spending less on the company, installment loans San Antonio there may become a period the place you wind up into the an excellent crunch. It may be on account of a summer slump inside the conversion, or perhaps it actually was surprise costs. No matter the reason, when you’re searching for brief resource for your providers, you can find services which will help.

PayPal Working-capital

In case your company is currently playing with PayPal, following PayPal Working-capital may be an excellent resource alternative. PayPal Working capital is a type of PayPal small business financing services and that angles your loan count about what you have won using PayPal during the last yearly.

To repay your loan, might like a fixed percentage between 10% in order to 30%. Once you receives a commission to your PayPal account, PayPal Working capital have a tendency to subtract new fee you decide on out of your each and every day earnings. It count will remain collected if you don’t repay the small company financing.

After you’ve received your loan recognition matter and you can chose good fees solution, dollars is placed in the PayPal account within minutes. Once you’ve repaid their PayPal Working capital Loan, you could potentially get another one.

Kabbage

Kabbage the most well-known business mortgage and you may funding financing functions. They’re going to get in touch with numerous functions (providers checking levels, ebay, Sage, Etsy, Craigs list, Approve, PayPal, etc.) to determine the worthwhile quantity of your online business mortgage.

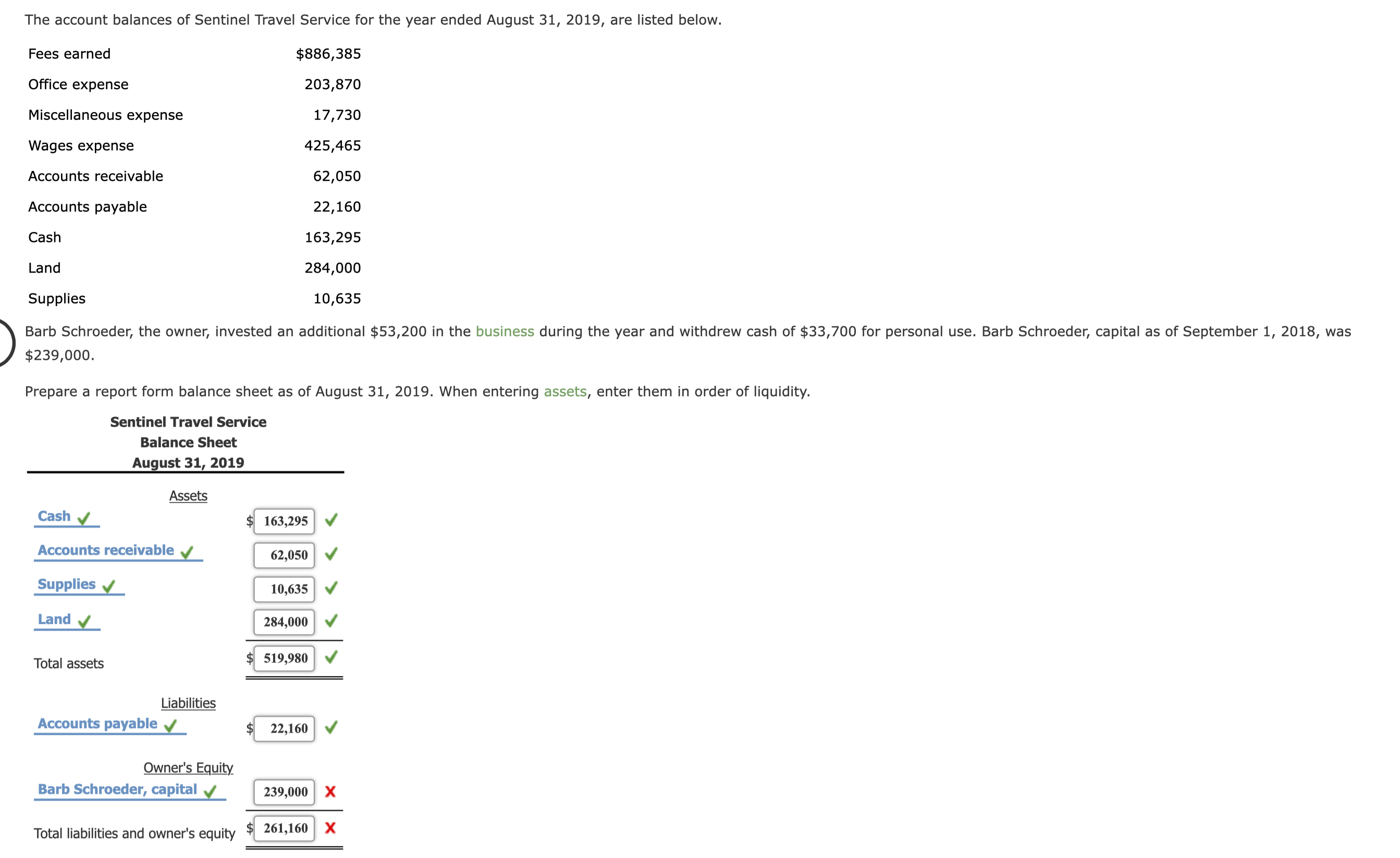

Decide to try business mortgage quantity, charges, and you will fees options are below. You can make use of their loan estimator and you may fee calculator to choose particular amounts applicable on the business.

After you’ve become approved for a loan, dollars can be deposited into the PayPal membership within minutes, otherwise placed towards the family savings contained in this a couple of days. You could potentially obtain portions of your Kabbage financing at a time, so that as your pay off the loan, you can use they once again as an element of another type of mortgage.

Is Money

Is Resource is actually an investment funding services that provides small company financing and you will supplier cash advances. So you’re able to meet the requirements, they ask you a few matter to decide your own business’s eligibility for a financial loan. Then there are to incorporate them with 90 days of financial comments to confirm your present earnings and perhaps consult with him or her of the cell phone to ensure your online business facts.

Try mortgage quantity, costs, and you may repayment options are the following. You can use the finance calculator to choose specific quantity appropriate to the business.

Immediately following approved, cash should be wired toward savings account in certain months. Installment options is going to be give regarding four to six months, and you can repayments is deducted from your own business checking account day-after-day.

OnDeck

OnDeck is actually a corporate mortgage services that gives small business fund according to annual money. In order to meet the requirements, they’ll want to know a few questions and get so you’re able to connect with your bank account (otherwise PayPal) to see the most recent comments, or you can choose manually post the statements. The latter increases just how long in order to approved for your enterprise financing. During this procedure, OnDeck’s disclaimer claims that it’ll struggle to import money, consider future comments, otherwise screen your bank account.

Immediately after recognized, cash is going to be wired towards savings account in one single time. Large people can get be eligible for loans with cost conditions spread out anywhere between several couple of years.

Best practices Whenever Taking Funding Financing

- Understand recommendations of every properties it comes to, particularly if you haven’t been aware of him or her in advance of. Specifically:

Maybe you’ve put one of several over features or some other you to getting business capital when you look at the a-pinch? That which was your own sense? Please express about statements below!