- EvoShare sends the money to the student loan-so you Related Site do not get the opportunity to purchase they very first.

4. Qoins

Qoins is another round-up app. Then software inspections your own expenses, rounds up your sales to the nearest dollars, and you may sends that money into the fund.

The application transfers their bullet-ups on the Qoins account after they arrive at $5, and you will delivers out money with the college loans once a month-or for the a repeated schedule, if you share with they to. Should you want to terminate an excellent Qoins withdrawal, you could-providing you terminate they on application by cuatro:forty five EST for a passing fancy go out it actually was initiated.

One thing that produces Qoins not the same as Altered is you won’t need to wait until you’ve attained a good $one hundred endurance observe repayments going to your education loan.

Qoins costs an excellent $step 1.99 a month fee to own deals, but if you haven’t any transactions one month, you do not get charged.

Benefits:

- No monthly fee if not generate an exchange one few days.

- Repayments score designed to your own education loan once a month.

- Build most payments on your debts without having to think about they.

5.

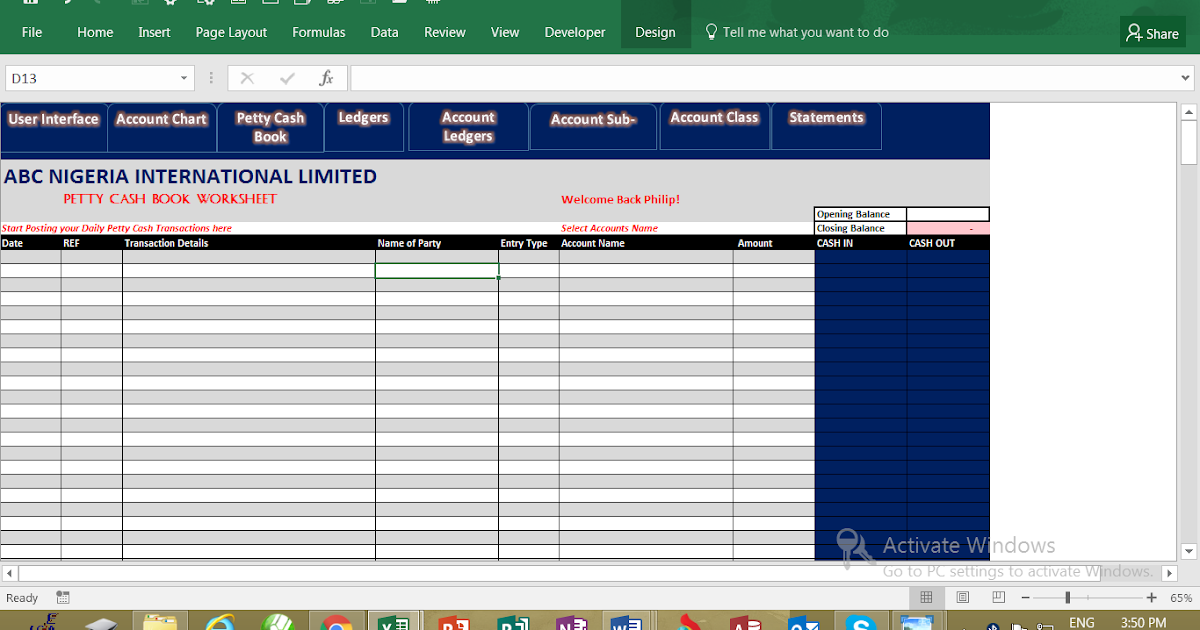

try a flush, simple education loan percentage calculator. In the event it started in 2011, it actually was mostly of the of their type. Now it is really not by yourself online, but it’s still an extremely beneficial product.

That have , you do not join up their accounts or build costs actually compliment of the latest application. No cash transform give. What you manage are enter the number of all of your current money, the eye you have to pay, as well as your monthly premiums.

The latest calculator can tell you how long it will require so you’re able to pay-off your fund considering your existing payment plan, in a simple-to-break down graph. It will show how much cash attention you happen to be spending.

From there, you could potentially play around. Observe how increasing the commission numbers could replace your financial obligation visualize-and you may test out brand new Avalanche otherwise Snowball method to pick and this create get the costs paid back less.

does not hook up to the accounts and make repayments to you personally. What it do manage was make you a very clear, at-a-glimpse image of the debt and how more percentage measures you may be right for you. You then come across a method and place it to your action for the their.

This new Avalanche method has you aggressively repaying your most costly mortgage first-the one on the large attention-and also make minimal payments for the rest of your financing. After you have paid down you to definitely of, you address the only toward 2nd-higher rate of interest, and so on.

The Snowball strategy provides you centering on your own tiniest loan first, and then make minimum costs to the your own other fund. Immediately following that is paid down, you handle next-minuscule, and ahead. It is a great opportinity for people that need the desire of some small very early successes.

Benefits:

- You should not undergo an extended membership-manufacturing process and connect their profile.

- Observe various other loans percentage steps apply at your debt image, without delay.

- 100 % free and very easy to use.

- Fool around with various ways to choose the best you to definitely to possess you.

six. Financial obligation Incentives Secretary

Financial obligation Rewards Secretary enables you to pick from several different personal debt incentives solutions to destroy from your own beginner financial obligation-as well as Snowball and Avalanche. It allows you to tune an endless amount of money-best for those with several personal and you may government student education loans.

If you want viewing graphic improvements, that is a great application to you personally. Personal debt Payoff Secretary offers maps and graphs indicating your full level of loans, the quantity you’ve kept to blow, your own total interest, and just how far you saved. Brand new reporting is much more involved than simply , although not so tricky you simply cannot obtain it at a glance.