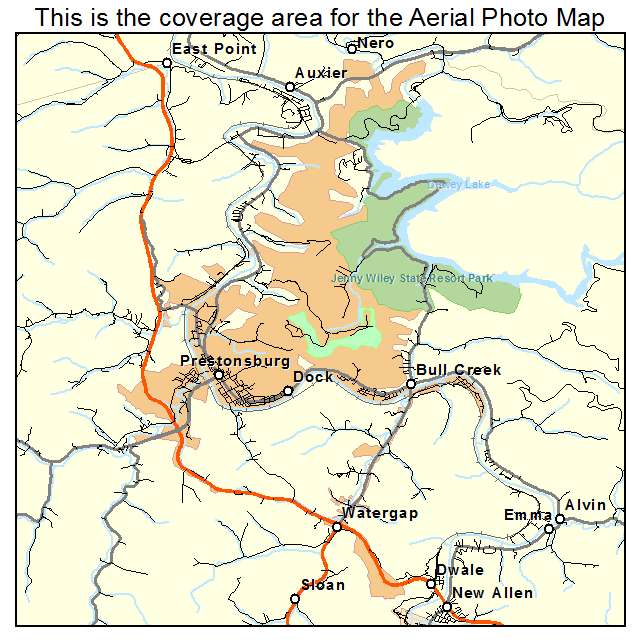

It is possible to very own a house and use the program, but the an incredibly book problem that USDA lets which. Usually the system is actually for those who currently lease or real time with family members. You will find several times however that meet the requirements. If you find yourself retiring out of upwards north and now have your residence offered you might use the system within Fl for those who qualify for each other repayments. If you have an impairment that really needs one alter your residence, for instance if the it isn’t wheel chair accessible then you might be eligible for an effective USDA mortgage even although you own another home. Simultaneously if your domestic no further has enough rooms to suit the size of your loved ones then the USDA could allow you to make use of the application form. For folks who now have a great USDA financial and want to pick other house or apartment with a beneficial USDA financial this can be done just like the long because you intimate on the newest house one which just personal towards the new house. New USDA program isnt an initial time domestic customer system however, the well suited for very first time homebuyers.

600 Lowest Credit rating

The application form really does support one to be eligible for a high amount borrowed whether your score is more than 640 even though. Oftentimes we could perform a USDA mortgage not as much as an effective 600 credit score down to 580. That have ratings between 580 and you may 640 a manual underwrite is necessary. Which have a hands-on underwrite brand new max the debt rates might be are . Which means your complete household payment must be 31% otherwise less of your income, as well as your complete monthly personal debt repayments on 41% or a reduced amount of your income. Bear in mind which have a score out of 640 youre a great deal more attending rating what’s named a great GUS acceptance that enables loans ratios doing a 30% front end and an effective 46% back-end.

Mortgage Insurance

The federal government provides a 1% financial support commission towards the Florida USDA mortgage program. Therefore almost any your own ft amount borrowed try, it will improve because of the step one% to fund its payment to save the applying going. There is a monthly grounds off .35% getting home loan insurance. This is below FHA otherwise very antique home loan insurance coverage. Its computed according to the prominent owed, so as the main minimises your home loan insurance rates payment decreases since well. Like should you have a $one hundred,100000 financing their financial insurance coverage is $350 per year, and you can $ thirty days. The borrowed funds insurance coverage into the government sponsored finance is the identical no amount what your credit rating was.

Florida USDA Financial to put it briefly:

New Fl USDA financial system is a fantastic system for an individual wanting to buy property. The genuine the very first time home consumer otherwise some body finding to invest in its 5th household. When your area you’re looking to acquire qualifies I inquire website subscribers to adopt is really as a choice. Its very easy to think discover a downside somewhere because your are not and come up with a downpayment but you their difficult discover when there is one! Especially when versus FHA capital. The program lets the pick a property to possess $0 off and offer your own independency in the possibility of financial support a few of your settlement costs. The mortgage insurance is low additionally the capital payment of just one% is actually lower. There was tend to an argument that USDA fund take longer so you can close however we obtain him or her closed just as brief because the all of our most other money. When we over all of our underwriting procedure the file is distributed to help you the newest USDA because of their recognition. This is accomplished under the USDA protected system. Tough circumstances i query members to locate 40 days to their home contracts to close off such but we are will bringing her or him done within thirty day period Flomaton loans. This step may take several working days, whether your USDA are copied it can possibly take more time. If you’d like to apply for a good pre-approval having good USDA financing follow on into the connect below therefore might be happy to aid. When you have after that questions just write to us.