Whatever the blend of school funding obtain, you, your parents and UC per possess a crucial role inside the spending for your degree:

- Students: UC anticipates one coverage part of the cost of attendance because of working and you will credit.

- Parents: UC needs parents to help you lead according to their savings and affairs while the said to your FAFSA otherwise Ca Fantasy Act Application.

- UC covers the rest will set you back which have present aid from a selection of provide. For every campus establishes your own full give qualifications and you may matches they using government, county and you can UC’s very own present help software.

Total price away from attendance: The cost of attendance try UC’s imagine of your annual finances while you are going to UC. That it figure lies in pointers you render in the economic help application and you may has tuition and charges, along with courses, housing, as well as almost every other living expenses.

Current services (100 % free $): Think about present assistance once the totally free currency that you can use to pay for your own academic expenses. Has and you can UC scholarships get into these kinds which help defense your cost of attendance (which has university fees and fees, space and you may board, books and you may provides, medical insurance, transportation, and private expenditures).

Online pricing: The online costs – the brand new piece both you and your moms and dads have to pay – is the total cost of attendance (or car or truck), with no provide aid you discovered. Which amount is a vital basis to consider once you compare their UC school funding promote in order to even offers off their universities.

Make payment on online prices

UC anticipates most of the undergraduate seeking to school funding to simply help safeguards their or the lady net costs because of a workable combination of performs and borrowing from the bank. Here is what we name thinking-help services: a mix of fund and you may earnings received off operate when you look at the academic seasons and you may june.

The quantity your parents are expected to spend is set built on the advice you provide into FAFSA or California Fantasy Operate Application. Having very low-earnings family members, there is zero moms and dad share asked.

Certain family fool around with a variety of most recent money and you will deals to shelter their express. For almost all parents, even if, the combination out of coupons and earnings isn’t really sufficient to defense most of the the internet can cost you.

How come everything complement along with her?

The latest graph lower than reveals just how school funding fits including mother and you can beginner benefits to purchase total cost off going to UC.

It suits just because the basics of knowledge your informative expenses, as price of attendance and financial aid access changes seasons to help you season, university in order to university.

- College students of lowest-money household and you can financially separate people will discover present assistance and you will big honors than just youngsters of high-earnings household.

- More provide help provided, the fresh new reduced youngsters and you will parents must contribute because of coupons, money otherwise funds.

- The greater money level, the higher the asked father or mother share.

- Projected pricing is sold with traditions on the university; the cost for college students who live out-of university is down.

Think of, also youngsters without financial you would like can put on for school funding. Although over 90% off gift help obtained by pupils are given toward basis away from you need, the great majority out of children at each earnings height located certain kind of current services.

What’s when you look at the a financial aid prize page?

Every scholar whom is applicable having school funding obtains a few things out-of for each and every UC university these include admitted to: a grants or scholarships promote (that may look unlike campus to help you university)and a standard prize letter titled a scholarships or grants looking sheet. Understanding how support performs (and understanding words including «websites rates») will help you to decode the fresh new page.

Often my personal educational funding render cover Most of the will cost you out-of probably UC?

Although students discover financial aid which covers the expense of university fees and you can charges, all educational funding people are required to pay for a https://www.clickcashadvance.com/loans/2000-dollar-payday-loan/ share of the cost of attendance courtesy working and you may credit.

Can you imagine my personal mothers can not or won’t pay its asked contribution?

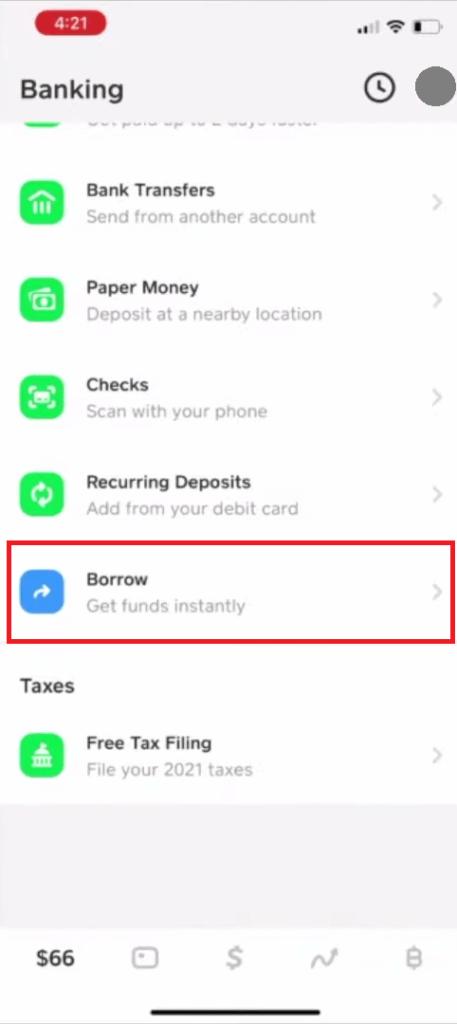

UC will endeavour to help you come across even more money which means you don’t have to works more than area-big date during the school. Often this type of is low-government, individual degree loans.