It’s hard to get approved to have less than perfect credit loans out of people lender. Luckily, there are numerous online loan providers that provide personal loans to those that have less than perfect credit if any borrowing from the bank whatsoever. They will not carry out tough credit inspections as a consequence of credit reporting agencies.

not, probably one of the most considerations can be done to switch your life would be to improve your bad credit score. It isn’t no more than bringing finance and mortgages it is more about to be able to book a condo, book an auto, if you don’t get work.

When you are seeking change your poor credit get, it will be a challenge. But we’re right here to help! Here are some ideas for you to try and alter your poor credit get:

- Pay off most of the a good stability.

- Pay bills promptly.

- You should never unlock one new handmade cards or personal lines of credit.

- Demand you to creditors reduce negative remarks from your own checklist (this might devote some time).

For people who struggle with this action and need money to own problems, loan providers can help with appropriate loan facts. Check this list and attempt to know what sort of mortgage usually meet your requirements.

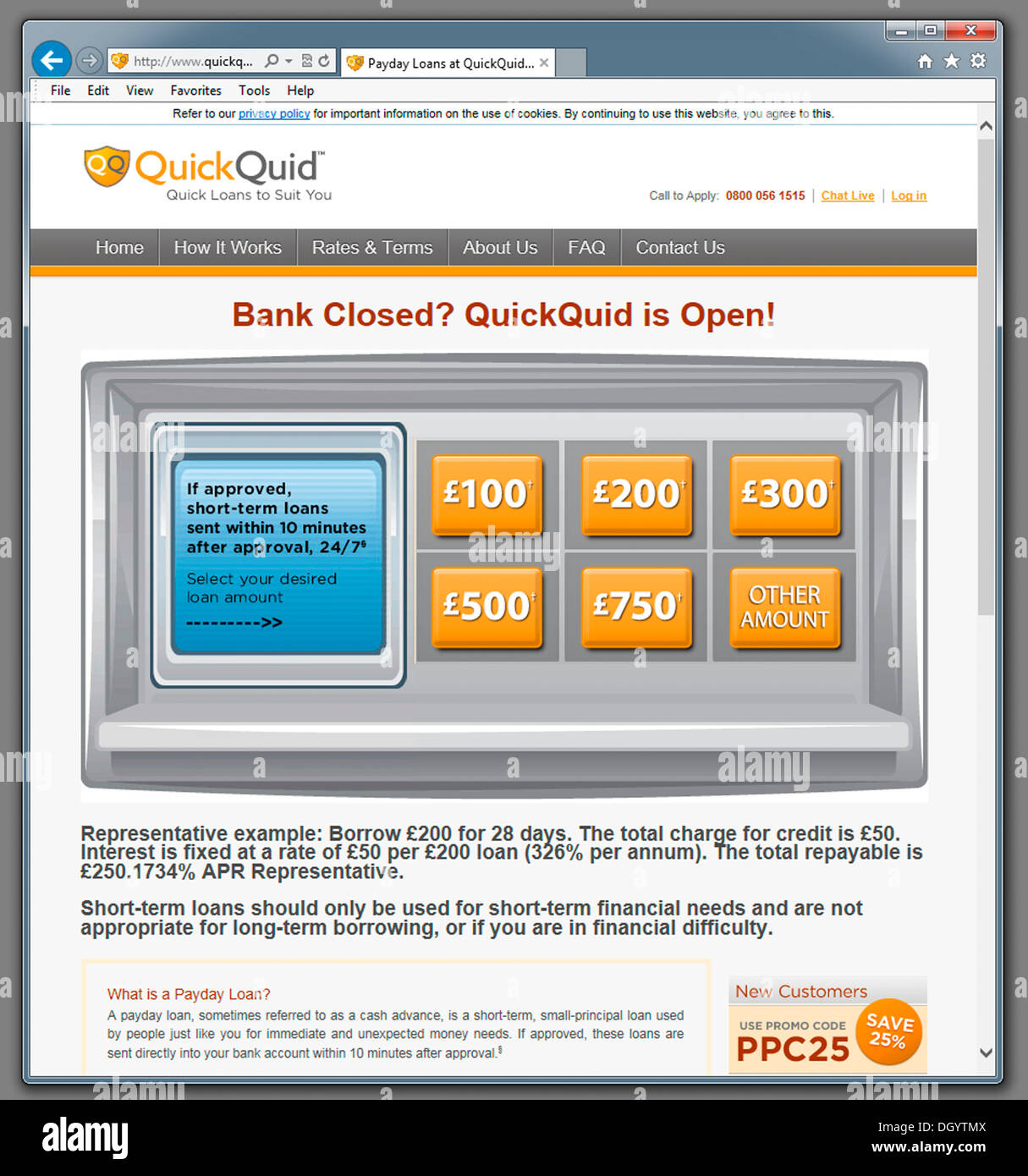

Payday loans

An instant payday loan is actually a preliminary-term financing that can be used to pay their expenses, purchase dining and other essentials, otherwise generate solutions for the vehicles. Cash advance are designed to help you get owing to an economic disaster without having to take out an extended-identity loan or happen a lot more loans. Brand new payday loans pricing is highest as compared to a lot of time-title on the internet signature loans

Cash advance loans

Cash advance payday loans are short-term financing which exist from an internet lender. These types of cash advances are meant to help you to get using an excellent harsh patch, and perhaps they are typically employed for issues otherwise unanticipated expenditures. You might acquire anywhere from $one hundred so you can $1,one hundred thousand simultaneously. The borrowed funds terms of this type of cash advances are pretty easy: you don’t have to worry about rates or fees arrangements you merely pay back a complete loan amount when possible.

Credit Builder Loans

Borrowing from the bank creator finance are a variety of mortgage which can help you build up your credit score. If you’ve been refused for a loan otherwise charge card prior to now, then it the clear answer you’re looking for. Credit creator fund are around for someone who has got become refused before because of their credit ratings. They make simple to use to track down accepted for a financial loan by taking good care of sets from start to finish.

Pawn Shop Financing

A great pawn shop financing is a kind of collateralized mortgage, in elitecashadvance.com tax refund cash advance emergency loans 2022 online which you explore a product or service that you own as the guarantee to help you receive a preliminary-title loan. The thing is actually held if you don’t pay the borrowed funds in full.

An excellent pawn shop is a type of providers where you could take an item which you very own and use it due to the fact security for a financial loan. You’ll spend attention to suit your borrowed money, however, next period comes to an end, you get right back their goods plus any cash left over out of that was owed with the mortgage. You may want to desire offer the item outright in the place of paying down the borrowed funds.

Unsecured loans

An individual cash advance is a type of unsecured otherwise shielded finance who has got a specific goal and can be used to buy expenditures, like scientific will set you back or domestic renovations. The new debtor must have a reliable credit history to help you be eligible for unsecured loans. That is a critical demands because the loan providers perform a difficult credit have a look at through credit scoring bureaus.