JP Morgan Pursue and you can Businesses roots go back so you’re able to 1799 just like the a lender already been of the Aaron Burr, Alexander Hamilton’s political adversary, from inside the New york. JP Morgan Chase expanded so you can its newest dimensions by the taking in good amount of highest banking companies historically. Today, the financial institution is simply a combination of 1200 different banking companies.

JP Morgan Chase’s mortgage organization is inspired by the remnants regarding Washington Mutual. Arizona Mutual was a pioneer for the financial lending and you may merchandising financial. JP Morgan gotten WaMu to escape personal bankruptcy within the 2008 into the economic crisis.

Chase mortgage refinancing points

Every lenders render various situations. If you are searching so you’re able to re-finance, check Chase Bank ‘s applications:

- 15-yearFixed-price mortgage

- 20-yearFixed-rates financial

- 30-yearFixed-price mortgage

Just like any repaired speed loans, the bonus is being aware what the rate of interest would-be having the life span of the loan. Since a customer, you will never have a rapid influx away from price, that makes budgeting simpler. Chase has the benefit of terms and conditions between fifteen so you’re able to 30-season repaired rates.

- 7-1 Case

- 5-step 1 Case

5-step one and seven-1 Possession include less explored, if your financial predicament matches these items, they truly are a good alternative. Adjustable-price mortgage loans is actually reduced than simply old-fashioned mortgage terms and conditions. Less terms generally feature good rates of interest, however, large monthly obligations. Just as in extremely Sleeve loans Alpine money, the speed is set for a decided period of time, after that usually go up or fall a-year, based business standards.

It’s ideal to simply accept a primary-identity loan whenever you are pregnant a rise in money, intend to live in the house for just a few years, was nearing the end of your current financing or anticipate interest prices to stay at the moment membership.

Recall, which have an arm, your own payment per month will change-over the life span out of the mortgage. The higher the mortgage you take aside while the a variable-price, the better risk your focus on in the event that interest levels rise. Maintain your eyes into the rate of interest forecasts before making a decision regarding the an enthusiastic Arm mortgage.

- FHA loans

Government Property Expert money try notorious in order to have flexible qualification requirements. Should your credit history requires a bit of really works, however, refinancing is very important for your requirements, imagine an enthusiastic FHA loan. It could be the best option. Though terminology are different, FHA money usually allow you to refinance to percent away from their house’s worthy of.

- Virtual assistant money

For many who qualify for good Va mortgage (military, veterans, reservists, partners from a military member, widows out of armed forces personnel, and more) youre at the mercy of straight down refinancing prices. These types of pricing can often be the full % less than good traditional refinancing financing, which can trigger nice coupons of your lifetime of your own financing.

- House Reasonable Refinance System (HARP)

HARP was made of the government, to aid home owners re-finance their houses at the less rates. Oftentimes, an assessment isn’t needed and you may less data are expected. We are going to dive on greater detail from the HARP fund below.

Pursue mortgage pricing now

The brand new Chase Bank refinancing cost is actually competitive. Chase, as with any other loan providers, usually takes a beneficial homeowner’s current financial obligation stream and you will background into consideration within the choosing an effective refinancing rate.

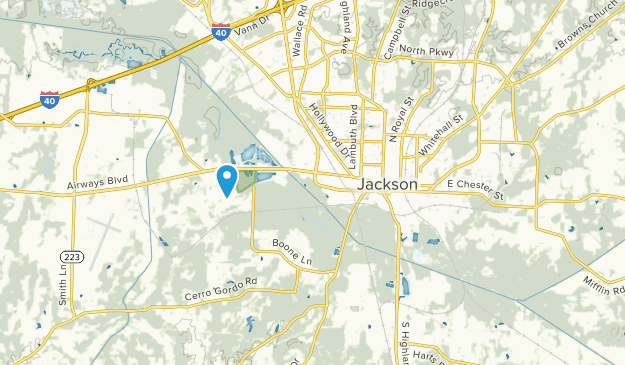

To find most recent Chase home loan refi rates near you, you will have to see Chase’s web site to get into the geo-particular pointers otherwise speak with a representative physically.

Just how do Chase’s points compare with almost every other financial institutions?

While Chase’s 29-year financial rates was much like Wells Fargo’s, Chase does not offer a course serious about its current consumers (aside from HARP) while most other regional banks particularly Wells Fargo, would. Present Wells Fargo Real estate loan people layered refinance option and thus zero closing costs or app and you will assessment charges towards customers. These charge can add up, and if you are currently a great Wells Fargo consumer, research the programs available at Wells Fargo tends to be on the best interest.