The cash payment journal is used to record the cash disbursements made by check, including payments on account, payments for cash merchandise purchase, payments for various expenses, and other loan payments. The cash payments journal records only cash outflow payments, cash payment journal adalah while cash collection is recording in the cash receipt journal. Consider the following example for a better understanding of how entries in a cash disbursement journal are made and how the posting to accounts payable subsidiary ledger and general ledger is performed.

- In this case the debit entry is to the accounts payable control account in the general ledger, and represents the reduction in the amount outstanding to suppliers.

- Furthermore, cash disbursement journals can help business owners with cash management by providing clear pictures of inventory expenses, wages, rental costs, and other external expenses.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- For each type of company, a cash disbursement journal will look very different.

Would you prefer to work with a financial professional remotely or in-person?

The line item posting to the accounts payable ledger would be for 400 to clear the supplier account. Finally the discounts received column total of 20 (in this case assume there is only one item for the accounting period) is posted to the general ledger discounts received account. The cash disbursement journal (also known as the cash payments journal) is a special journal that is used by a business to manage all cash outflows. In other words, a cash disbursement journal is used to record any transaction that includes a credit to cash. All cash inflows are recorded in another journal known as the cash receipts journal.

Understanding a Cash Disbursement Journal

Normally most cash payments are to suppliers for credit purchases and the subsidiary ledger updated is the accounts payable ledger. In the above example, 550 is posted to the ledger account of supplier A, and 350 to supplier C. When posting to the accounts payable ledger, a reference to the relevant page of the journal would be included. The cash disbursement journal, sometimes referred to as the cash payments journal, is a special journal used to record the payment of cash by a business. The journal is simply a chronological listing of all payments including both cash and checks. The journal is used to save time, avoid cluttering the general ledger with too much detail, and to allow for segregation of duties.

Cash Disbursement Journal is Updated from Source Documents

Journal managers must be detail-oriented and they must fastidiously record every transaction to help prevent cash from being misdirected or misappropriated. Furthermore, cash disbursement journals can help business owners with cash management by providing clear pictures of inventory expenses, wages, rental costs, and other external expenses. The credit to the cash account represents cash paid to suppliers for the period, which decreases the asset of cash. If the entity makes credit purchases, then all the purchases are recordings in the purchase journal.

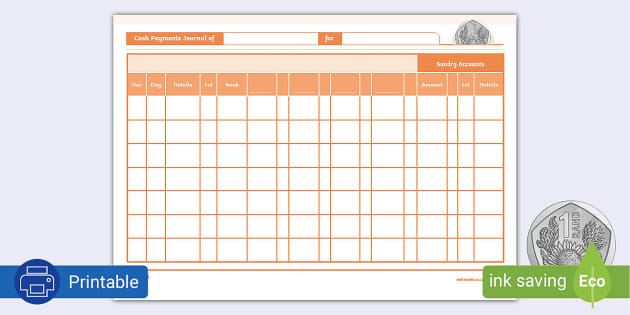

If necessary, other specific account columns can be added if they are used routinely. The debit columns will include at least an Accounts Payable column, a Purchases column, and the Other Accounts column. Credit amount is obviously cash, while the debit amount is normally expenses or assets that the payments are made to.

It is important to realize that the cash receipt journal is a book of prime entry. For this reason the entries in the journal are not part of the double entry posting. Generally maintained by accounting software, these journals contain essential information such as the disbursement amount, check number, transaction type, payee, payer, and memo.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. At the period end two checks are carried out to prove the information has been correctly transferred to the ledgers. The main source of entries for this journal are check stubs and payment requests.

The cash receipts journal is a special journal used to record the receipt of cash by a business. The journal is simply a chronological listing of all receipts including both cash and checks. The use of the journal saves time, avoids cluttering the general ledger with detail, and allows for segregation of duties. Additionally in some businesses, the cash receipts journal is combined with the cash disbursements journal and is referred to as the cash book. In other words, this journal is used to record all cash that comes into the business.

In this case the debit entry to the cash account represents the cash collected from customers for the period, which increases the asset of cash. This is a very simplistic example but would show how transactions are recorded. Both the cash amount has to be recorded under the cash credit account and the same amount has to be debited from a corresponding account. Depending on the type, that account could be an inventory account or any other traditional balance sheet account. Suppose in one month, Company ABC purchases a machine from Manufacturer BZY for $5,000 and rents a truck from Rental Trucks for $500. The company would need to credit its cash balances and debit corresponding accounts.